The Reconciliation Bill that passed Congress was signed into law on July 4, 2025, as Pub-lic Law 119-21 contained provisions for “No ax on Tips”, “No Tax on Overtime”, “No Tax on Car Loan Interest”, and several other provisions.

The “No Tax on Overtime” is only a catchphrase that interests most Mail Handlers. It sounds great! However, it is not as great as it was advertised. It sounded like there would be no federal income tax on all paid overtime hours. The truth is that the new federal income tax on overtime is restricted and limited. It does not make all overtime tax-free!

This is a new tax deduction, effective for 2025 through 2028. Individuals that receive overtime compensation may deduct the pay that exceeds only their regular rate of pay – that is, the “half” portion of “time-and-a-half” compensation. Which is required by the Fair Labor Standards Act (FLSA) and that is reported on a Form W-2.

What does the “half” portion of “time-and-a-half” compensation, required by FLSA equal? The straight time salary rate for a Level 4 top step Mail Handler is $36.57 an hour. The overtime salary rate for a Level 4 top step Mail Handler is $54.86 an hour. The “half” portion of the “time-and-a-half” compensation is $18.29 an hour. ($54.86 minus $36.87, equals $18.29) Only this “half” portion is deductible. But there are restrictions.

The deduction restrictions include: the maximum annual deduction is $12,500 ($25,000 for joint filers) and the deduction phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers). The cap on the deduction ($12,500/$25,000) is only a deduction. It does not mean that you will have that dollar amount of overtime tax-free.

The Postal Service will be sending a Supplemental Form W-2 Data – Tax Year 2025 letter to employees regarding the tax deduction for the premium portion of Fair Labor Standards Act (FLSA) overtime that some employees may be eligible to take under the One Big Beautiful Bill Act. The letter will identify the overtime an employee was paid in 2025 that qualifies for the deduction.

The overtime deduction is available to both those who itemize their deductions and those who use the standard deduction. To be eligible to claim this deduction you must include your Social Security Number on the tax return and must file jointly if married. If you are married, you cannot file tax returns separately, to claim this deduction!

What is FLSA Overtime? The Fair Labor Standards Act (FLSA) is a federal statute which applies to the Postal Service. The FLSA provides that the Postal Service must pay an employee covered by the over-time provisions of the Act at one and one-half times the employee’s regular rate for all hours of actual work in excess of 40 hours in any FLSA workweek. FLSA is defined as actual work or all-time which management suffers or permits an employee to work. Actual work does not include any paid time off.

Because the deduction is only available for FLSA overtime, overtime that Mail Handlers receive under the National Agreement that is beyond what the FLSA requires is not eligible for the deduction. For example, if you have paid leave in a work week while also working overtime in the same work week, the overtime you received for work in excess of 8 hours in a day may not be deductible because you did not work more than 40 hours in a week. The FLSA limitation can also affect MHAs. For ex-ample, if an MHA works four (4) hours of overtime early in a work week - but is not scheduled for a total of forty (40) hours – working only thirty-eight (38) straight time and overtime hours in a week combined, the four (4) hours of overtime is not deductible. You must have worked beyond forty (40) hours in week (not counting leave hours) in order for overtime compensation to be deductible.

Remember, this is just a tax deduction; it is not a tax credit and all overtime is not exempt from taxation. The deduction can only be claimed when you file your annual tax return. It is not as a reduction of your payroll withholding. This means your paychecks will still have taxes withheld as usual throughout the year. Some professionals estimate there will be only a small decrease of federal income tax.

This - “half” portion of overtime deduction - only applies to federal income tax. This change in federal tax law does not apply to state (and local) income tax. Overtime is still subject to federal Social Security and Medicare taxes.

Please discuss this new deduction with your professional tax preparer. This article is not to provide income tax advice. This is NOT ‘fake news.’ More information can be found at www.irs.gov The IRS will be providing more guidance on how to handle the tax deduction for overtime.

The so-called Big Beautiful Bill is not as big and beautiful as advertised.

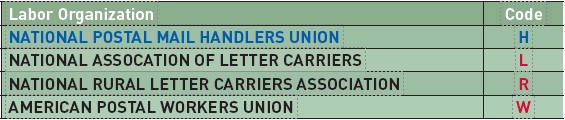

UNION DUES CODES

Many times, members think they are paying Mail Handlers union dues, but do not realize that HRSSC entered the wrong Union code. They see a deduction for “Union Dues” but is it the correct code? The proper NPMHU Union Code should be “Union Dues: H”.

If you or a fellow coworker is incorrectly paying dues to another Union, contact your Local Treasurer or the National Office. We can get this corrected quickly and easily.

If a member didn’t receive a copy of the recent Mail Handler Magazine, they might be paying dues to another Union.